Minister Sindisiwe Chikunga believes that the youth of South Africa are crucial for the country’s industrial growth and have enormous potential for the country’s welfare. She proposes specialized programs to tackle youth unemployment and foster innovationled industrial strategies, including opportunities in green manufacturing, the ocean economy, agriculture, mining, and energy transitions. She calls for the establishment of an Action Plan and a Youth Unemployment Crisis Committee to ensure the proposed interventions are executed promptly. Minister Chikunga stresses the need for sincere evaluation and profound interventions, moving beyond surfacelevel alterations to the system, and establishing intelligent industrial towns and cities in strategic locations outside traditional urban centers.

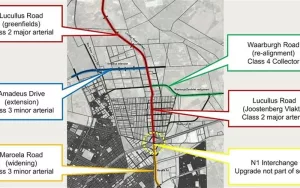

The City of Cape Town is involving residents in the redesign of road infrastructure in the Kraaifontein region through public engagement opportunities and open public days. The project aims to reshape road infrastructure in growing regions and prioritize growth areas through proactive planning. The city is committed to democratic involvement and invites all residents to express their thoughts and comments on the proposed designs before presenting the final designs to the Council for approval.

Unleashing Ownership Opportunities: The Revolutionary Influence of Human Settlements Title Deeds Initiative

The Human Settlements title deeds initiative in Cape Town distributed 2,000 title deeds to qualifying beneficiaries between June and July 2024, utilizing a doortodoor methodology that showcased community cooperation. The initiative has redefined the lives of recipients and bears witness to the commitment and determination of personnel and title deed agents. Title deeds are emblems of possession and sovereignty, integral to financial transactions, and the initiative’s success indicates a commitment to enabling residents and unlocking new possibilities. An estimated 12,000 title deeds are still awaiting delivery, and beneficiaries without a title deed are encouraged to interact with title deed agents.

Cape Town is taking action to address the need for affordable rental housing by revising the Municipal Planning Bylaw to attract micro and smallscale developers to invest in areas where housing is urgently needed. The proposed changes aim to establish and manage these developments, leading to higher quality, safer housing units that are legally connected to essential services. By introducing spatial policies and strategies, the city plans to construct safer, better quality homes in informal settlements and backyards, aligning with Objective 8 of the City’s Integrated Development Plan.

Cape Town’s Expanded Public Works Programme (EPWP) plays a crucial role in generating employment opportunities and developing skills for its residents. The program has evolved from creating job opportunities to serving as a platform for skills development, enabling recruitment into a variety of fields. The city has invested over R460 million in multiyear skills development projects, providing practical work experience and training for unemployed residents and fostering a more inclusive economy.

The Community, Arts and Culture Department of Cape Town is offering nonprofit organizations the opportunity to apply for GrantsinAid funding amounting to R3 230 046. This funding is dedicated to creative and cultural projects that target young individuals and marginalized groups such as women, children, the elderly, and persons with disabilities. The projects aim to enrich the city’s cultural milieu and enhance the community’s overall wellbeing, with a focus on accessibility and diversity. The city is committed to making cultural and creative activities more accessible, nurturing talent, and promoting cultural activities in neighborhoods.

Delft’s Urban Waste Management (UWM) EPWP Entrepreneurship Trainee Programme is a city initiative in South Africa that provides entrepreneurs with the necessary skills and abilities through a series of training and development modules. This programme’s holistic approach combines practical mentorship with theoretical knowledge and helps city entrepreneurs realize their business objectives while contributing to job creation and revenue growth among participating businesses. Bonolo Holdings, a family enterprise, has seen considerable growth under the guidance of this city initiative, and its success is a testament to the programme’s effectiveness in supporting small businesses on their journey towards expansion and success.

Cape Town has launched a new branding strategy called “Embrace Cape Town” to boost tourism. The initiative builds upon previous successful marketing efforts and showcases the city’s diverse oceanic adventures, investment opportunities, and rich cultural spectrum. The comprehensive fivepoint action plan aims to enhance flight connectivity, cruise tourism, conferences, tourism attractions, and targeted marketing to catapult the tourism economy to new heights. The city’s commitment has already generated significant growth and success in the tourism sector, contributing to the local economy and generating employment opportunities.

Luspin Manufacturers is a successful textile company in Khayelitsha, led by entrepreneur Pinkie Hlengisa. Their commitment to quality and dedication to handson learning experiences for degree students has contributed to their growth. Luspin’s workforce includes four fulltime employees, 12 trainees, and 13 distributors, with expertise spanning a variety of clothing items. Pinkie’s entrepreneurial journey has been guided by the City’s Expanded Public Works Programme (EPWP) Entrepreneurship Trainee Programme, highlighting the transformative power of governmentfunded education and training schemes. Luspin’s success story serves as an inspiration for aspiring entrepreneurs in the community.

The largest amount ever given to a South African municipality has been granted by the International Finance Corporation (IFC) to Cape Town R2.8 billion in infrastructure funding. This funding will be used to modernize the city’s water, sanitation, transport, and electricity systems and create 130,000 constructionrelated jobs. Cape Town plans to allocate R39.5 billion to infrastructure modernization by June 2027 and has secured funding from a diverse financing model that includes local and international funds. This move toward modernization is a symbol of Cape Town’s progressiveness, resilience, and inclusivity.

The V&A Waterfront in Cape Town has undergone a major upgrade, worth R20 billion, transforming it from a functional port into a thriving centre of commerce, hospitality, and tourism. The site has initiated a rezoning application to bring its vision for the Granger Bay area to life, with future plans that include reestablishing public access to the ocean’s edge. The public is encouraged to participate in this process, making it a collaborative endeavour to preserve and improve the city’s iconic site.

The Maitland Crematorium has undergone a massive renovation, showcasing a blend of modernization and tradition. The upgrade includes two advanced cremators adhering to Air Emission Standards, a revolutionary SCADA Electronic Logging System, an extended cold storage room, and a hydraulic coffin lift. Despite a slight drop in cremations due to upgrades and repairs, the crematorium remains committed to providing dignified and respectful options for all residents, while the city sees a shift towards more personalized and spaceefficient memorials.

Canal Walk Shopping Centre in Cape Town, South Africa is committed to environmental sustainability and has won the 5star Green Star Existing Building Performance Award for their efforts. They have decreased energy consumption by 34%, use water 44% more efficiently than the industry standard, and have implemented sustainable waste management methods. Their commitment to sustainability is evident in their daily operations, making them a leader in the retail industry’s adoption of green practices. They serve as an example for other retail entities to follow.

South Africa’s property market is a robust platform for homeowners, buyers, sellers, and investors. While the Covid19 pandemic caused significant obstacles for the market, there is still hope for the future. Interest rate reductions later this year could provide a muchneeded boost, and the upcoming twopot retirement system launch could potentially increase household disposable income by a large amount, providing a lift to the property market. Despite the challenges, the market remains resilient, embodying the unyielding optimism and spirit of South Africa itself.

The Western Cape Department of Health is pioneering healthcare initiatives by constructing new facilities such as the Klipfontein, Belhar, and New Tygerberg Central hospitals. These projects aim to improve healthcare accessibility and efficiency in the area, despite financial limitations and challenges. The Klipfontein Regional Hospital and Belhar Regional Hospital projects are set to be completed by 2033, while the New Tygerberg Central Hospital project has an estimated budget of R11 billion and is set to begin construction between 2028 and 2032. Despite financial obstacles, the department remains committed to its objective of providing accessible healthcare for all.

Women in South Africa have overtaken men and mixedgender couples in property ownership, with women owning 38% of all properties. This trend began in 2016 and has continued to increase, highlighting women’s financial independence and the country’s progress towards gender equality. Women are not just home buyers but also investors, using real estate as a tool for wealthbuilding and financial freedom. Despite this, women still see their properties as homes first and investments second.