The mining industry has long been essential to the South African economy. This has not changed in recent years, with recent updates on the state of the industry showing that the impact of mining amounts to 7.53% of the nation’s GDP. That figure is up to date as of 2022 and was supplied by the South African Revenue Service (SARS), with Mineral Resources and Energy Minister Gwede Mantashe stating that the findings make for “a clear indication that mining remains a strong pillar of our economy.” As much as this statement appears to be correct, however, it has also become clear that there are major changes coming to the South African mining industry in the near future. How and when these changes materialise will have a significant effect on the nation’s economy in the coming decade.

Changes Coming to the South African Mining Industry

By nature, the mining industry is at once stagnant and dynamic. On the one hand, it is functioning generally in the same way it has for generations –– and with the same goals. On the other, actual mining practices have always been subject to change, typically due to advancing technologies or shifting mineral and resource priorities. In the near future, however, the South African mining industry is likely to face more comprehensive changes in service of two primary goals: sustainability and legality.

Changes for Sustainability

South African government officials and resource management leaders alike are well aware of the increasingly dire state of the environment on Earth. Carbon dioxide levels are rising at dangerous rates, and there are profound negative implications for our climate if trends continue. Mining is by no means solely responsible, but it has long been known that many standard mining practices are detrimental to the environment. For this reason, some of the primary mining industry changes we expect to see in the near future have to do with sustainability.

Lots of specific sustainability-oriented changes are likely to be on the horizon. At this stage, however, the main shifts toward sustainable mining are expected to concern alternative fuel and power for mining practices. Hydrogen power, electricity, and batteries are all being considered already, with Caterpillar, in particular, having been singled out as a company promoting underground mining equipment driven by clean energy. Additionally, some mining companies around South Africa are exploring the use of solar and wind power to “greenify” their operations, with Gold Fields and Sibanye-Stillwater reportedly leading the way.

Some of these changes are still theoretical or in development stages. It is clear, however, that there is real momentum toward the use of clean energy in mining operations throughout South Africa.

Changes for Legality

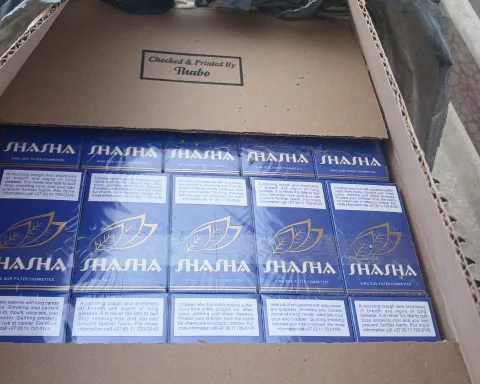

Additional changes in the South African mining industry are expected as efforts to combat illegal mining intensify. As has been discussed previously, illegal mining is a threat to the economy, the environment, and even human lives throughout the country. Unfortunately, however, these practices persist. For this reason, we have seen the Justice, Crime Prevention, and Security Cluster of South Africa ramp up its efforts to combat illegal mining.

This is a less defined category in that there is no definitive change that can be made for the sake of legality. Any South African mining organisation can make a clear, direct decision to start a transition toward sustainable operations. It cannot, however, simply press a button and eradicate unsafe and illegal competition. Should the Justice, Crime Prevention, and Security Cluster make progress toward eradicating unlawful practices, however, the effort would leave space for safe, fair, and responsible mining by established companies.

Effects on the Economy

As stated, the mining industry accounts for between 7 and 8% of the GDP of South Africa. This means that any major changes in the industry will inevitably affect the country’s economy –– as well as the outlook for private investors with a stake in the industry. With this in mind, it is worth considering the specific ways in which the coming changes may shift the economic landscape.

Interruptions in Output

Changes toward sustainability and legal practices will carry long-term benefits. Change takes time, however, and it is at least possible that during the process, mining production and output will decline. If this proves to be the case, valuable resources that help prop up the South African economy and private investors’ accounts alike may temporarily be in shorter supply. None of this is guaranteed, but an interruption in output is a plausible scenario that could temporarily depress some aspects of the economy.

Changes in the Commodities Market

As mentioned previously, there are a lot of private investors in South Africa (as well as abroad) who have a stake in the mining industry as well. These are people who have gotten used to the practice of trading commodities through a handful of useful investment platforms that have sprung up in the last decade. These platforms give traders the opportunity to expand their portfolios by buying into resources ranging from precious metals to energy products –– including gold, coal, and other products from South African mines.

For the most part, these commodity investment platforms are designed to help traders safeguard portfolios against major losses. There are stop-out protections and automated trading mechanisms that can set accounts to sell if commodity prices drop to certain thresholds. For this reason, interruptions in mining output leading to lower-than-normal supplies should not be cataclysmic for savvy investors. Even so, however, if there are lulls in South African mining while changes are implemented, it may be more difficult for private investors to profit.

Stagnant Employment

In a 2019 report citing mining statistics, it was noted that from 2015 to 2019, the mining workforce expanded by more than 3,700 individuals. This looks promising at first glance. However, it was further explained that this increase came primarily from employees from “subcontractors and labour brokers” as well as those working on “projects that fall outside the daily scope of business.” Meanwhile, the number of workers employed directly by the mines declined.

It is difficult to project how sustainability- and legality-related changes in the mining industry will affect employment in the long run. Given the nature of growth in recent years, however, it is reasonable to expect some stagnation in employment. A focus on the promotion of sustainable mining operations and the rooting out of illegal ones is likely to restrict some opportunities for subcontractors, labour brokers, and other third-party outfits. Leading, reputable mining companies should rise to the forefront of the industry. The hope is that, in time, these same companies will thrive and find themselves employing more people. During the transition, however, mining employment could well become stagnant.

Conclusion

Ultimately, changes to the South African mining industry should have a net positive effect. They are on track to make the industry meaningfully more responsible from an environmental standpoint, as well as curb illegal, harmful activities. Once these changes are further along, mining businesses will likely be in a position to be as productive or more so than ever, as well as to have more control of their respective markets. These effects should, in turn, lead to a strengthened economy. It is also possible, however, that during the interim period when changes are being implemented, there are some temporary economic struggles relating to GDP, private investment, and employment numbers.