Navigating the South African Property Market can be challenging due to high home prices. The current median price for a home in South Africa is around R972,200, requiring a monthly income of roughly R35,120. The Western Cape has particularly high property values, with an average home price of around R1.6 million. The Residential Property Price Index is a helpful tool for understanding the housing market in South Africa and tracking changes over time. It is important to keep in mind the ideal mortgage payment should not exceed 30% of a buyer’s gross monthly income, and potential homeowners should carefully consider their financial circumstances before committing to homeownership in South Africa.

The Reality of Homeownership in South Africa

The current median price for a home in South Africa sits at R972,200, requiring an individual or family to earn roughly R35,120 per month. This figure is higher than the average salary earned by formally employed workers outside of the agricultural sector. Thus, the reality of homeownership remains a significant financial burden across the country.

The Western Cape Housing Challenge

The task of acquiring a residence in Western Cape, South Africa, with its elevated property values, is indeed a daunting one. With an average home price sitting around R1.6 million, a monthly income exceeding R58,000 is required. This figure is nearly double the income requirements set forth by other provinces.

A Detailed Overview of the Residential Property Market

A comprehensive snapshot of the residential property market in South Africa is provided by the latest Residential Property Price Index (RPPI). This index is a collaborative effort between Statistics South Africa (Stats SA) and the South African Reserve Bank (SARB). The RPPI provides a plethora of information, including data on properties sold for the first time, properties that have been resold, sectional title properties, and freehold properties.

The primary objective of the RPPI is to track the trajectory of residential property prices over time, taking into account both new and old dwellings. The considered prices are market prices that include the cost of the land that houses the residential structures.

Property Price Fluctuations in the Past Five Years

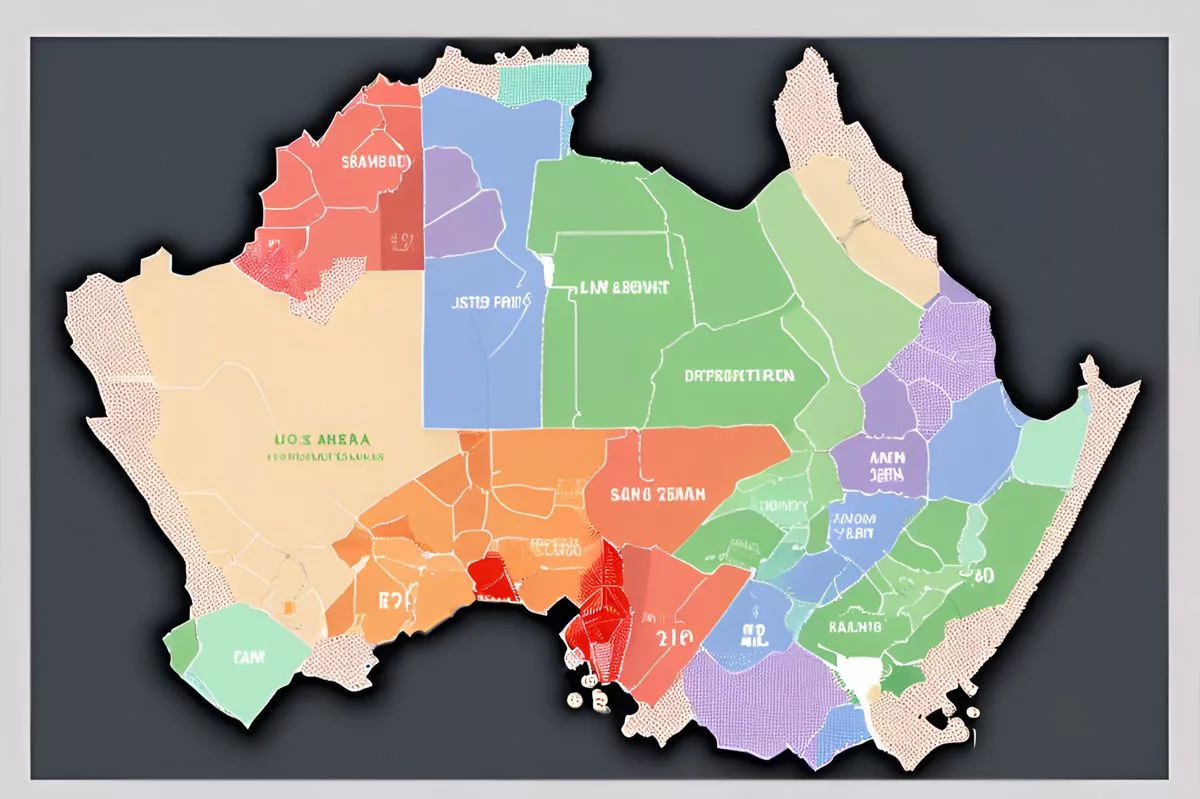

As per the report, over the last five years, residential property prices have experienced a rise of 23.8%, which roughly equates to an annual increase of 4.8%. However, this growth has not been evenly distributed across all provinces. The Western Cape saw a significant hike in property prices, marking a 35.5% increase, the highest in the country. In stark opposition to this, the Northern Cape only experienced a meager growth of 0.9%.

When the figures are adjusted for inflation, property prices across the country show a decrease of 3.9%, considering a 27.7% rate of inflation during the same period. This drop suggests a deflation in property values in the majority of provinces. However, even after adjusting for inflation, the average price of a South African home remains elevated, surpassing the income of a typical worker employed outside the agricultural sector.

The Mortgage Payment Ideal

Richard Gray, the CEO of Harcourts South Africa, believes that ideally, mortgage payments should not surpass 30% of a buyer’s gross monthly income. This cap ensures that homeowners are able to meet their repayment obligations without destabilizing their overall financial balance.

Adhering to Gray’s 30% guideline, BusinessTech carried out calculations to determine the income needed to purchase an average home in each province. These computations, made on the basis of a 20-year mortgage at an interest rate of 11.75%, utilized Absa’s bond calculator and property prices obtained from Property24. Property24’s data was compiled from over 190,000 registered property sales with the deeds office in 2024.

The Reality of Homeownership in South Africa

The current median price for a home in South Africa sits at R972,200. To afford this, an individual or a family needs to earn roughly R35,120 per month. This figure is R8,329 above the average salary of R26,791 earned by formally employed workers outside of the agricultural sector.

Even in the Free State, which boasts the lowest average house price at R800,000, a monthly income of R28,900 is necessary. This figure still surpasses the average salary. Thus, the reality of homeownership remains a significant financial burden across the country.

In conclusion, buying a home in South Africa, particularly in the Western Cape, is a sizable financial endeavor. However, the potential for property appreciation and the allure of owning a piece of this stunning land may sway some towards homeownership. Nevertheless, it is crucial to consider one’s personal financial circumstances and readiness to take on such a commitment.

1. What is the current median price for a home in South Africa and what is the required monthly income to afford it?

The current median price for a home in South Africa is around R972,200, requiring a monthly income of roughly R35,120.

2. What is the average home price in Western Cape, South Africa?

The Western Cape has particularly high property values, with an average home price of around R1.6 million.

3. What is the Residential Property Price Index and what information does it provide?

The Residential Property Price Index (RPPI) is a helpful tool for understanding the housing market in South Africa and tracking changes over time. It provides a comprehensive snapshot of the residential property market in South Africa, including data on properties sold for the first time, properties that have been resold, sectional title properties, and freehold properties.

4. How have property prices fluctuated in the past five years in South Africa?

Over the last five years, residential property prices have experienced a rise of 23.8%, which roughly equates to an annual increase of 4.8%. However, this growth has not been evenly distributed across all provinces. The Western Cape saw a significant hike in property prices, marking a 35.5% increase, the highest in the country.

5. What is the ideal mortgage payment percentage of a buyer’s gross monthly income?

The CEO of Harcourts South Africa, Richard Gray, believes that ideally, mortgage payments should not surpass 30% of a buyer’s gross monthly income.

6. How much income is needed to purchase an average home in each province in South Africa?

BusinessTech carried out calculations to determine the income needed to purchase an average home in each province, based on a 20-year mortgage at an interest rate of 11.75%. Adhering to Richard Gray’s 30% guideline, the income needed ranges from R28,900 in the Free State to R58,000 in the Western Cape.