The Standing Committee on Finance is visiting Ithala Bank following the suspension of its Financial Services Provider (FSP) license due to operational issues. The committee aims to ensure that the bank meets financial health standards and rectify any setbacks. The visit includes discussions with stakeholders and the objective of reinstating the bank’s FSP license. The committee’s swift action demonstrates decisive leadership and dedication to maintaining financial stability in South Africa.

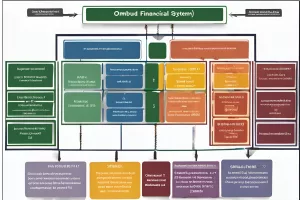

South Africa’s financial ombud system is undergoing major reforms with the launch of the National Financial Ombud Scheme and the Retirement Funds Ombud. The changes are based on recommendations from a World Bank diagnostic study and aim to enhance consumer safeguards and promote better results within the financial services industry. The reforms will require legislative amendments and the National Financial Ombud Scheme is expected to start operations on March 1, 2024, leading to a promising future for South Africa’s financial sector.

In a recent move that reflects South Africa’s openness to investment and trade, Rand Merchant Bank (RMB) has established a presence in the heart of New York City, reiterating its longstanding economic ties with the United States. ### South Africa’s Unique Position Among Emerging Markets