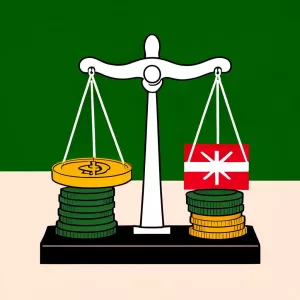

The South African Reserve Bank (SARB) has decided to keep interest rates steady at 7.5% as it carefully weighs the risks of inflation and the need for economic growth. While some politicians want to lower rates to help struggling consumers, experts warn that the economic situation is complex. A recent survey shows a slight improvement in inflation expectations, which gives reason for cautious optimism. SARB’s choice reflects its tough job of balancing growth and inflation while navigating both local and global challenges, all while the pulse of everyday life in South Africa beats on through vibrant art, music, and stories of resilience.

South Africa’s economy is at a crucial point, with exciting but uncertain changes ahead. The Reserve Bank might cut interest rates soon, which could help families and businesses. However, challenges like a proposed VAT increase and tricky relations with the U.S. add to the complexity. While inflation looks good now, many people worry about future growth, with forecasts suggesting slow recovery. As the country waits for important decisions, the mix of local culture and global ties will shape its economic journey.

South Africa’s property market is a robust platform for homeowners, buyers, sellers, and investors. While the Covid19 pandemic caused significant obstacles for the market, there is still hope for the future. Interest rate reductions later this year could provide a muchneeded boost, and the upcoming twopot retirement system launch could potentially increase household disposable income by a large amount, providing a lift to the property market. Despite the challenges, the market remains resilient, embodying the unyielding optimism and spirit of South Africa itself.

The South African property market and economy have been dealt a blow with the Reserve Bank’s decision to keep the repo rate at 8.25%, causing frustration and disappointment among industry figures. The high interest rate, combined with rising living costs and a stagnant economy, is putting pressure on everyday South Africans, particularly middleclass homeowners. Despite this, there is hope for the future, with anticipated interest rate cuts and the Government of National Unity’s potential to drive economic growth. Homebuyers may find themselves on the brink of a golden opportunity amid the current challenges.