Diversification is a crucial strategy for forex traders in Cape Town, who can benefit from a wide range of currency pairs and international events but must navigate unstable emerging markets and geopolitical factors. Diversification involves spreading investments across different currency pairs, timeframes, strategies, and asset classes to control risk exposure while seizing a broader range of opportunities. Traders should mitigate exposure to emerging market currencies like the South African rand and consider factors like liquidity limitations and domestic economic data releases. Gradually entering positions and avoiding illiquid pairs during significant announcements can help reduce risk.

Embracing Diversification in Forex Trading

Diversification is an essential element of the precarious forex marketplace. It serves as a linchpin in risk management by ensuring potential losses in one area are offset by possible profits in others. This method of dispersifying investments across various currency pairs, trading periods, and strategies provides a safety net against risk exposure.

In the high-speed world of foreign exchange trading, transactions involving global currencies can transpire within a blink of an eye. Here, risk management and profit augmentation hinge on a crucial strategy—diversification. The principle of forex is pretty straightforward, buying and selling currencies based on fluctuating exchange rates in a market that sees $6 trillion worth of daily activities. However, for Cape Town’s forex traders, diversification brings both opportunities and challenges.

Cape Town’s advantageous geographical position and ties to international markets, enable traders to benefit from a wide range of currency pairs and worldwide events. Nevertheless, this necessitates the ability to adeptly maneuver through unstable emerging markets and decode complex geopolitical factors. This piece explores the importance of diversification for forex traders in Cape Town, analyzing strategies for risk dispersion across different currency pairs, trading styles, and various asset types. It also discusses ways to overcome barriers such as access to training and building trust within the local forex society.

Embracing Diversification in Forex Trading

Diversification is an essential element of the precarious forex marketplace. It serves as a linchpin in risk management by ensuring potential losses in one area are offset by possible profits in others. This method of dispersifying investments across various currency pairs, trading periods, and strategies provides a safety net against risk exposure. For beginner traders in Cape Town, diversification can be particularly beneficial, enabling them to gradually acquire experience in varying market conditions while reducing potential losses.

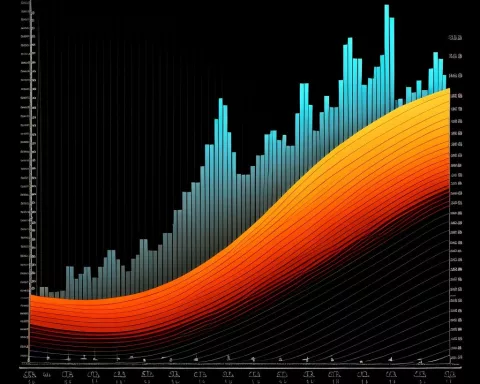

Diversification in currency pairs, a vital tactic, entails trading a mix of major pairs (e.g., EUR/USD, GBP/USD), minor pairs (e.g., EUR/GBP, GBP/JPY), and exotic pairs (e.g., USD/TRY, EUR/ZAR), to reduce the risk of overexposure to a single currency. Timeframe diversification merges short-term trades like scalping or day trading with long-term positions such as swing trading or trend trading. Likewise, strategy diversification utilizes various technical and fundamental analysis techniques.

Broadening the Scope: Asset Class Diversification

Branching out into asset class diversification allows traders to expand beyond currency trading and incorporate other instruments like commodities, indices, or even cryptocurrencies. This strategy enables traders to spread risk across different market drivers. In addition, the application of effective risk management tactics is vital to limit potential losses, deter overleveraging, and adjust portfolios as market conditions change.

The Cape Town forex market exhibits some unique traits that traders should bear in mind when diversifying their portfolios. Being a prominent financial hub in South Africa, the city has a clear emphasis on emerging market currencies like the South African rand (ZAR) and other African pairs. Local traders should mitigate exposure to these pairs with major pairs to distribute risk more effectively.

Navigating Challenges and Implementing Strategies

Furthermore, traders in Cape Town need to consider factors like liquidity limitations during local market hours and the effects of domestic economic data releases. Risk reduction can be accomplished by adopting strategies such as gradually entering positions and steering clear of illiquid pairs during significant announcements.

Diversification proves to be an essential instrument for forex traders, particularly those based in Cape Town, aiming to successfully navigate the unpredictable currency markets. By spreading investments across currency pairs, timeframes, strategies, and asset classes, traders can control their risk exposure while seizing a broader range of opportunities. This dynamic field requires constant learning and adaptability to changing market conditions. As a core principle, diversification should be adopted by forex traders beginning this journey. Start small, experiment with different strategies, and continuously refine your methods to achieve steady profitability.

1. What is diversification in forex trading?

Diversification in forex trading is the strategy of spreading investments across different currency pairs, timeframes, strategies, and asset classes to control risk exposure while seizing a broader range of opportunities.

2. Why is diversification crucial for forex traders in Cape Town?

Forex traders in Cape Town can benefit from a wide range of currency pairs and international events but must navigate unstable emerging markets and geopolitical factors. Diversification allows traders to mitigate exposure to emerging market currencies like the South African rand and distribute risk more effectively.

3. What are some diversification strategies in forex trading?

Diversification in forex trading can be achieved through a variety of strategies, including diversification in currency pairs, timeframe diversification, strategy diversification, and asset class diversification.

4. What is asset class diversification in forex trading?

Asset class diversification in forex trading involves branching out beyond currency trading to incorporate other instruments like commodities, indices, or even cryptocurrencies. This strategy enables traders to spread risk across different market drivers.

5. What challenges do forex traders in Cape Town face when diversifying their portfolios?

Forex traders in Cape Town should consider factors like liquidity limitations during local market hours and the effects of domestic economic data releases. Risk reduction can be accomplished by adopting strategies such as gradually entering positions and steering clear of illiquid pairs during significant announcements.

6. Why should beginner traders in Cape Town consider diversification?

Diversification can be particularly beneficial for beginner traders in Cape Town, enabling them to gradually acquire experience in varying market conditions while reducing potential losses.